Understanding

Option Trading Basics

A successful execution of options strategies depend on a thorough understanding of option trading basics.

The very first few questions in your mind when you start to learn option trading will be:

1) What are Stock Options?

2) Places where options are traded

3) Rights and Obligations of Option Traders

4) Advantages and disadvantages of options?

Click here to ask a question or discuss in more detail on the fundamental of option trading

After learning these fundamental, you will need to know what is the;

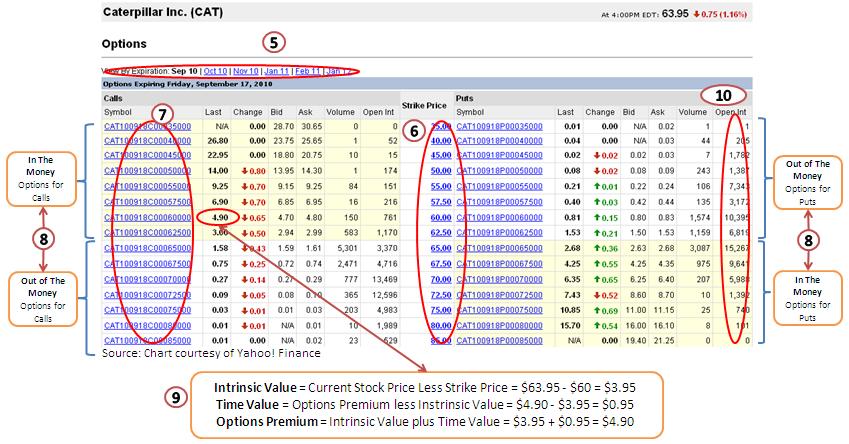

5) Options expiration dates

6) Strike price

7) Stock option quotes naming convention

8) In the money, out of the money and at the money options

9) Intrinsic Value and Time Value

10) Options open interest

11) Exercise options and options assignment procedures

12) Factors that influence option valuation

Below is an example of option table for Caterpillar Inc. (CAT). All these quotes will not be so confusing after you have learnt the basic option trading knowledge.

A complete understanding of the option trading basics will help an option trader to decide which option strategies is most suitable to him, or is he suitable for trading option.

One of the important issues to take note is that an option buyer can lose his entire investment in a short time. Uncovered option seller may be subjected to a even bigger financial risk.

Keep in mind that most option traders have many years of trading experience.

So don't expect yourself to be an expert in options trading after absorbing the above information.

On the other hand, do not feel intimated by the large amount of information that is coming your way.

Take your time and learn at your own pace.

If you have understood the fundamental of option trading and the risk involved, let's move on to find out how the various options trading strategies may help you to profit in different market conditions.

Is Understanding Option Trading Basics

Give You A Hard Time?

Use this space to discuss on the basics of options trading, share your knowledge on essential options concepts or how options might fit into your trading portfolio.

Everyone is welcome and you can ask a question or comment on any topics that you are interested. It's free, educational and easy to do! Join in!

What Other Traders Have Said

Click below to see discussion from other traders on option trading basic or add in your own comments...

Option Dates

Why did November 2013 have 2 different option dates ie. (Nov 19 and Nov 28) and October have two option dates listed?

"Anadarko" and "Met life" …

Option Assignment Procedures: How soon will Covered Call write be exercised after strike price reached

I own XOM stock long and want to write a covered call with an out of the money strike price with an expiration date two years out. If the strike price …

Weekly Expiration Not rated yet

Why are there two expiration Fridays in this month? GE in August 2011 for example.

Comment on options “Weekly Expiration" date.

TSO Reply: Hi …

Thanks For Sharing Not rated yet

I absolutely adore reading your blog posts, the variety of writing is smashing. This blog as usual was educational, I have had to bookmark your site …

Option Strike Price Not rated yet

New. Having a hard time here understanding option strike price and hope for a good explanation.

If stock XYZ is trading at $50 and you want to buy …

Option Premium: How To Reduce Premium As Expiry Date Is Getting Nearer. Not rated yet

How to reduce option premium as expiry date draw near?

How to calculate it and determine if it is beneficial to take this time?

Dinesh Kumar

Comment …

Next learn how to apply various Options Trading Strategies to help you make profit on different market conditions.

Return from Option Trading Basics to Trade Stock Option