In The Money, Out of The Money

& At The Money Options

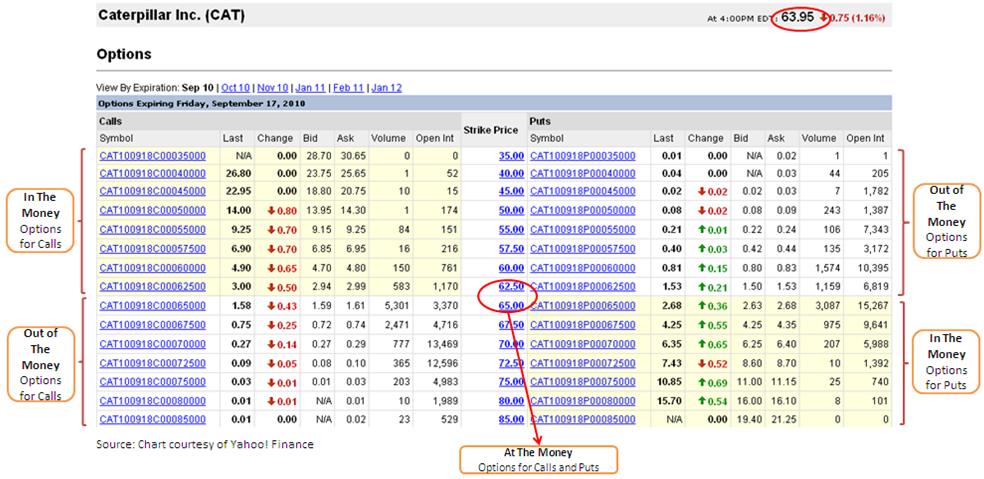

As an option trader, In The Money, At The Money and Out of The Money are the three terms that you need to get yourself familiar with. They illustrate the important relationship between strike price and current price of the underlying security. This is one of the basic stock options trading principles that you need to know.

Beginner who just started to learn option trading often get confuse on these three terms.

For Call Options

In The Money = Strike price is lower than the underlying stock price.

(ie Able to make profit by buying the stock at a price that is lower than current market price)

At The Money = Strike price is equal to the underlying stock price

(ie No different between buying the stock from open market or buying stock through exercising the call options)

Out of The Money = Strike price is higher than the underlying stock price.

(ie. Unable to make any profit by exercising the call options as the buying price is higher then current market price of the underlying stock)

For Put Options

In The Money = Strike price is higher than the underlying stock price.

(ie. Able to make profit by selling the stock at a price that is higher than current market price)

At The Money = Strike price is equal to the underlying stock price

(ie. No different between selling the stock through open market or selling it through exercising the put options)

Out of The Money = Strike price is lower than the underlying stock price

(ie. Unable to make any profit by exercising the put options as the selling price is lower then current market price of the underlying stock

Below is an example of Caterpillar Inc. (CAT) option contract to illustrate the point on the relationship between strike price and the current stock price.

As a general rule, options that is in the money by at least 2 strike price and consist mainly of intrinsic value is referred to as Deep In The Money options.

At the money options tend to have the highest liquidity and greatest open interest.

In general, an option contract is consider to be far out of the money if the strike price is at a level where it is highly unlikely to become in the money.

What is Intrinsic Value and Time Value? How it affect your trading decision? To know more about their different? Click here!

Return from In The Money, Out of The Money and At The Money Options to Option Basics