Options Open Interest

Options open interest is merely the number of open option contracts that exist on a particular underlying stock. It is the option contracts that have been opened by traders and not yet closed. This means that the contract is not yet liquidated by ways of offsetting the trade, exercise of options or assignment of the underlying stocks when trading stock options.

Open interest for individual options are reported each day by the various exchanges and the Option Clearing Corporation.

An opening transaction is the initial transaction, either a buy or a sell.

Example: If your opening transaction is to buy 10 of IBM Oct 100 call, you are entering into a “buy to open” contract. This action will increase 10 to the open interest figure of IBM Oct 100 call. When you “sell to close” the contract, ie when you sell away the 10 options to close the contract, the open interest is reduced by 10.

If your opening transactions is to sell 10 of IBM Oct 90 call, you are also consider as “sell to open” the contract. This action will increase 10 to the open interest figure of IBM Oct 90 call.. When you “buy to close” the contract, ie when you repurchase the 10 options to close the contract, the open interest is reduced by 10

Each opening transaction adds to the open interest and each closing transaction reduces the open interest.

There are several reasons why the open interest of an option changes;

- When the option moves higher into the money, the number of option contracts will change due to trader close off their position, roll forward or exercise.

- Buyer will tends to close out their position when the option’s intrinsic value increase and seller will tends to close their position when the time value of the option reduced.

- When expiration dates approaches, fewer new contracts will be opened.

- Volume of open interest will also change when the perceptions among buyer and seller of the particular underlying stock changes.

Do note that an open interest does not differentiate between a buyer and a seller and there is no way to know there are more buyers or sellers. Due to this reason, a lot of options traders ignore the information on open interest.

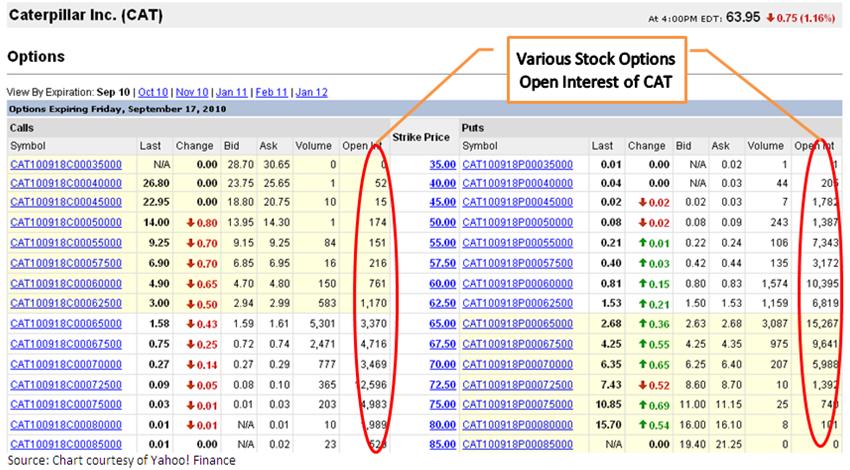

Below is an example of options open interest from Caterpillar Inc. (CAT)

An options open interest is important in determining the liquidity of the option under consideration. If there is a large open interest, there will be little problem in making fairly large trade. If the open interest is small (eg a few hundred) there might not be a reasonable secondary market in that options series. Therefore options with large open interest allows the trader to trade the options at a more reasonable bid and offer spread.

Are you curious about how option contract can be exercised or assigned? Find out more at Procedures on Options Exercise and Assignment

Return from Options Open Interest to Option Basics