Long Put Options Strategy

Direction: Bearish

Strategy Description

A Long Put Options strategy involves the purchase of a put option.

Outlook: With a long put, your outlook is bearish.

You are expecting a drop in the underlying stock price and/or a rise in volatility.

Risk and Reward

Maximum Risk:

- Limited to the amount of premium paid for the put options (May loss 100% of amount invested in this option trading strategy)

Maximum Reward :

- Potentially unlimited to the downside of the underlying stock.

Breakeven :

- Strike Price minus Premium Paid

- This is a net debit trade because you pay for the put option.

Advantages and Disadvantages

Advantages:

- Unlimited profit potential with limited risk.

- Requiring less capital than shorting the stock outright.

- Time decay.

- Potentially 100% loss on amount invested if the strike price, expiration dates or underlying stock are badly chosen.

Exiting the Trade

- Sell the put options and close off the position at a profit.

- Sell the in the money put option and use the proceed to purchase a out of the money put.

- Create a spread by selling an out of the money put against the current long put position.

- Let it expire worthless (not recommended).

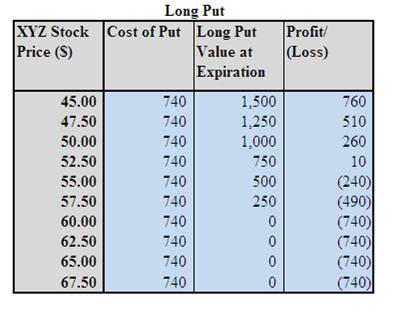

Long Put Options Example

Analysis of Long Put Options Example

Maximum Risk = Premium Paid = $7.40 * 100 = $740

Maximum Reward = Potentially unlimited to the downside of XYZ.

Breakeven = Strike Price minus Premium Paid = $60 - $7.40 = $52.60

Buying (Long) a put option has many similar characteristics as buying a call option, except that it is in the opposite direction. As most individuals is familiar with buying asset and profit from the increase in asset value, buying a put option makes it equally easy to profit from a decline in the underlying stock price.

A Long Put Options usually increases in value due to the drop in the underlying stock price or increase in volatility. It usually decreases in value due to time decay, a rise in underlying stock price or contraction in volatility. Try to ensure that it is a downward trend when you are using this option trading strategies and identify a clear area of resistance.

Option is a wasting asset and time decay work against you in this strategy.

To get better trades than shorting the stock itself, do ensure that you give yourself enough time to be right.

Generally this means that you should only buy put options that expire in more than 3 months. A method for buying a shorter term option is to buy only deep ITM options.

Buying deep ITM option is more expensive but the attraction is that it is straight forward and almost can have point for point price movement of the underlying stock. Buying OTM option is cheaper and offers you higher leverage but it is also a low-probability strategy.

You should pick the strike price and time frame of the put

options according to your risk profile and forecast. Selecting the best

strike price at the appropriate time frame is a balancing act between

paying as little as possible while trying to gain the highest possible

profit potential.

Related Strategies

|

|

|

Bear Put Spread

|

Short Put

|

Long Straddle

|

Next go to another bearish strategy, Short (Naked) Call, to learn how it can be used in a bearish market.

Return from Long Put Options to Option Strategies