Short Call Options Strategy

Direction: Bearish to Neutral

Strategy Description

A Short Call Options, also known as Naked Call Options strategy, involves the sale of a call option. Selling option is also known as “writing” an option.

Outlook: When you short (sell) a call options, your outlook is bearish or neutral.

You are not expecting the price or volatility of the underlying stock to increase significantly.

Risk and Reward

Maximum Risk:

- Unlimited to the upside of the underlying stock. (May loss more than the amount of premium collected if you do not have a build in risk management feature in this option trading strategy)

Maximum Reward :

- Limited to the amount of premium collected.

Breakeven :

- Strike Price plus Premium Collected

Net Position:

- This is a net credit trade because you collect premium from the sale of call option

Advantages and Disadvantages

Advantages:

- Time erosion of options values help writer of call option.

- May profit from three scenarios: underlying stock price fall, move sideways, or rise by a relatively small amount.

- Requiring less capital than shorting the stock outright.

- Does not require capital outlay and can earn interest while you trade.

- Unlimited risk to the upside of the underlying stock.

- Potentially may loss more than the amount of premium collected if the strike price, expiration dates or underlying stock are badly chosen.

Exiting the Trade

- Let the option expire worthless and earn the full sum of premium collected

- Buy back the call options and close off the position at a profit.

- Buy a lower strike call of the same expiration date and create a Bear Call Spread Strategy.

- Time decay will erode the value of the option everyday. Assuming all other variables being equal, option seller (writer) will be able to buy back the option at a lesser value then what has been paid initially.

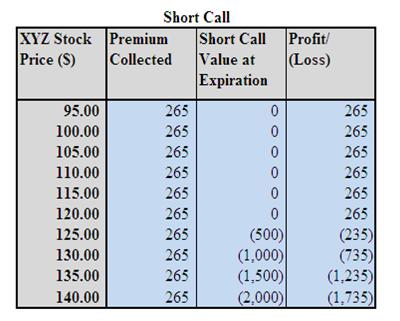

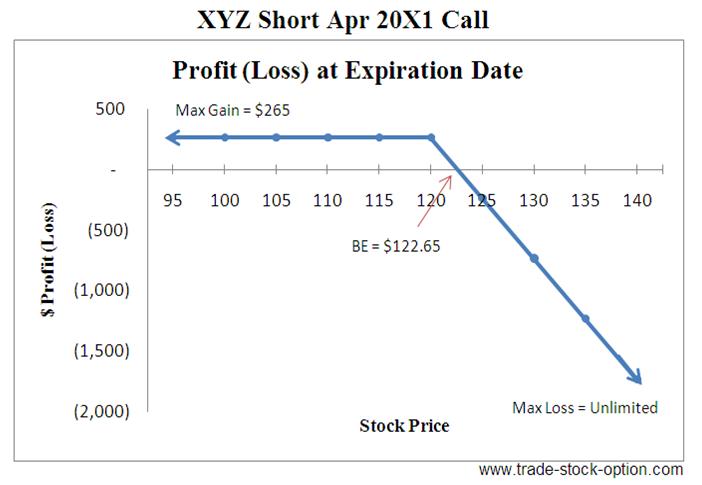

Short Call Options Example

Assumption: XYZ is trading at $118.57 a share on Mar 20X1. You are expecting share price of XYZ to drop or move sideway. In this case, you may consider to sell one Apr 20X1 $120 strike call at $2.65 to profit from the bearish or neutral outlook of the stock. Note: commissions are NOT taken into account in the calculation.

Analysis of Short Call Options Example

Maximum Risk = Unlimited

Maximum Reward = $265 (premium collected).

Breakeven = Strike Price + Premium Paid = $120 + $2.65 = $122.65

Selling an option does not require you to be precise on the direction, timing or magnitude of the move and you enjoy the benefit of time decay. An option writer can also structure the naked call in a way to enjoy a higher statistically probability of success than shorting the stock or buying a call option.

A call option usually increases in value due to the rise in the underlying stock price or increase in volatility. It usually decreases in value due to time decay, drop in underlying stock price or contraction in volatility. Therefore, to get the maximum return from trading a naked call, try to ensure that the underlying stock is in a downward trend or at least range bound and identify a clear area of resistance. The maximum gain is realized when the underlying stock is at or below the strike price at expiration date

Option is a wasting asset and time decay (in your favor) accelerates exponentially in the last month before expiration. To get better trades than shorting the stock itself, do ensure that you give yourself as little time as possible to be wrong. Generally this means that you should only short options that expire in less than 1 month.

One important point to take note is that if you short a call and is

assigned, you will be forced to short the underlying stock at the strike

price.

In order not to be forced to short a stock that is

rising and exposed to potentially unlimited losses, only select the

strike price around an area of strong resistance within the context of

falling trend.

Although this is one of the simple stock option strategies to execute, shoring a call options (without any risk management features) is a risky strategy as you are exposed to unlimited losses if the stock rises.

A single loss from this strategy can wipe out a few years of profit from shorting option. Most of the brokers will only allow experience traders to trade this strategy. As such, this is not a strategy that I would recommend to an inexperience trader.

You should pick the strike price and time frame of the short call

options according to your risk profile and forecast. Selecting the best

strike price at the appropriate time frame is a balancing act between

collecting as much premium as possible while keeping the risk exposure to

the minimum.

Related Strategies

|

|

|

Covered Put

|

Covered Calls

|

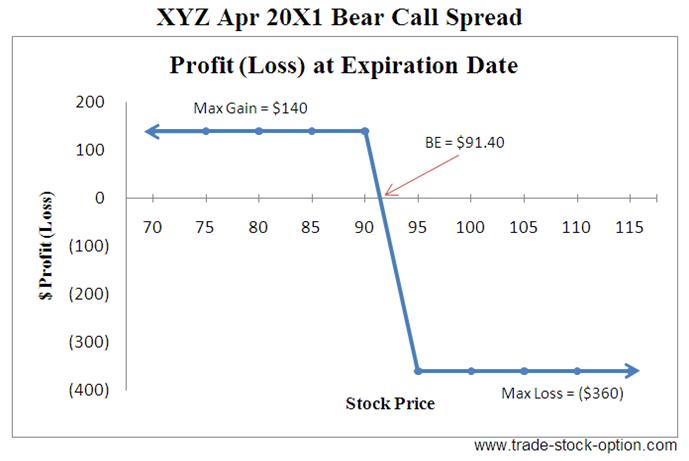

Bear Call Spread

|

Next go to another bearish strategy, Covered Put, to learn how profit can be make from a bearish stock.

Return from Short Call Options to Option Strategies