Long Call Condor

Direction: Sideways

Strategy Description

Long Call Condor is one of the sideway strategies employed in a low volatile stock. It is usually a four-legged spread option strategy consisting of all calls with the same expiration date but different strike prices. It is similar to a Long Call Butterfly strategy except that a condor has two middle strike prices instead of one. Typically the distance between each strike prices are equal for this strategy.

Long Call Condor =

- 1 ITM Long Call + 1 ITM Short Call + 1 OTM Short Call + 1 OTM Long Call OR

- 1 Lower strike Bull Call Spread + 1 Higher strike Bear Call Spread OR

- Short Strangle with limited risk exposure.

Outlook: With this stock option trading strategy, your outlook is directional neutral.

You are expecting a drop in volatility or no movement from the underlying stock.

Risk and Reward

Maximum Risk:

- Limited to the amount of Net Premium Paid for the call options (May loss 100% of amount invested in this option trading strategy).

Maximum Reward :

- Limited to the different in adjacent strikes less net premium paid when the stock is between the two middle strike prices (at expiration).

Breakeven :

- Upside Breakeven = Highest Strike less Net Premium Paid

- Downside Breakeven = Lowest Strike add Net Premium Paid.

- This is typically a net debit trade even though the cost is normally relatively low.

Advantages and Disadvantages

Advantages:

- Profit from a range bound stock with relatively lower cost outlay.

- Relatively higher risk/reward ratio if the stock remain range bound.

- Limited risk exposure when the underlying stock is beyond the two breakeven points on expiration date.

- Bid/Ask spread from the various option legs may adversely affect the profit potential of the strategy.

- The higher profit potential is only realized when the options are close to expiration date.

Exiting the Trade

- Offset the position by buying back the call options that you sold and selling the options that you have bought in the first place.

- As the underlying stock fluctuate up and down, advance option traders may choose to unravel the spread leg by leg. In this way, the trader will leave one leg of the spread exposed while he profit from the closure of the other legs.

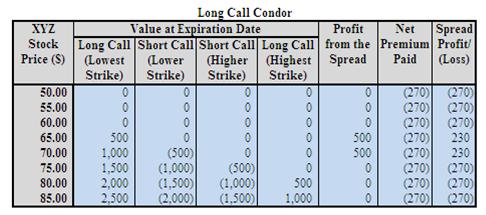

Long Call Condor Example

Assumption: XYZ is trading at $68 a share on Mar 20X1. It had just announced its earning result and no major news for XYZ is expected in the near future. Based on your analysis, you believe that the stock will trade within $60 to $75 within the next month. You would like to profit from the low volatility outlook of the stock but with higher profit potential (as compare to a Long Call Butterfly) and with limited risk exposure (as compare to a Short Strangle).

In this case, you may consider to buy one $60 strike call at $8.60, sell one $65 strike call at $4.90, sell one $70 strike call at $2.70 and buy one $75 strike call at $1.30, all expiring in Apr 20X1, to profit from the low volatility outlook of the stock. Note: commissions are NOT taken into account in the calculation.

Analysis of Long Call Condor Example

Maximum Risk

= Limited to the amount of Net Premium Paid

= ($8.60 - $4.90 - $2.70 + $1.30) * 100 = $230

Maximum Reward

= Limited to the different in adjacent strikes less net premium paid

= ($5.00 - $2.30) * 100 = $270

Upside Breakeven

= Highest Strike Price Less Net Premium Paid

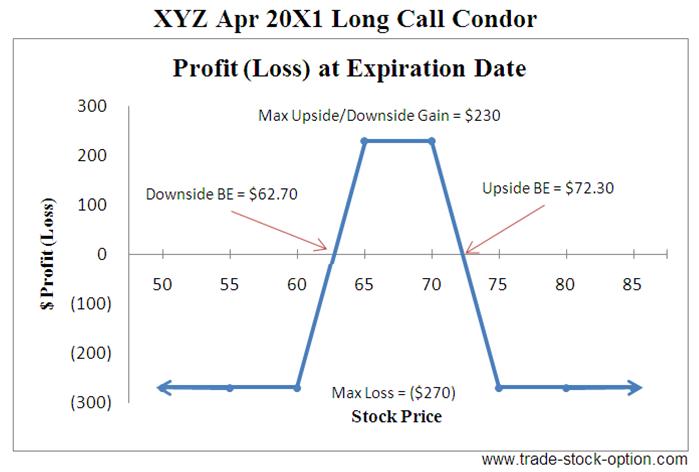

= $75 - $2.70 = $72.30

Downside Breakeven

= Lowest Strike Price Add Net Premium Paid

= $60 + $2.70 = $62.70

A Long Call Condor is similar to a Long Call Butterfly strategy and consist of call options. It gets the name from the shape of its profit and loss graph at expiration. The 2 outside strike are commonly referred to as the wing, whereas the 2 middle strikes are commonly referred to as the body. It is the opposite of Short Call Condor, which is a volatility strategy.

The two long options at the outside strike ensure that the risk is limited on both sides. This is also a much more conservative strategy than the Short Strangle and profit area is wider than Long Call Butterfly.

Try to ensure that the stock is trading range bound and identify clear areas of strong support and resistance. The stock is also anticipated to consolidate (become less volatile) and trading sideway for the duration of your trade. Usually a higher debit is paid for the Long Condor in comparison to a Long Butterfly strategy. This is due to the deeper In The Money options that the Long Condor is begin with.

Time decay is generally helpful in this strategy when it is profitable and harmful when it is in a loss position.

When you enter the trade, the stock price will typically be in the profitable area of the risk profile.

Therefore

it is preferably to use this option trading strategy with around 1

month left to expiration so as to give yourself less time to be wrong.

You may also execute the Long Condor strategy using all puts options. When all puts options are used, it is referred to as the Long Put Condor strategy. The characteristic of Long Put Condor is the same as a Long Call Condor. As to whether a condor strategy should be executed using all calls or all puts options depend on the relative price of the option. The premium of both puts and calls option should be taken into consideration to achieve the optimum trade.

You should pick the strike price and time frame of the Long Call Condor according to your risk/reward tolerance and forecast outlook of the underlying stock. Having the patient to wait, knowledge to apply and discipline to follow through the option trading strategies with appropriate risk-reward parameters is important to your long term success in option trading.

Related Strategies

|

|

|

Long Iron Condor

|

Short Strangle

|

Short Call Condor

|

Next go to another volatility strategy, Long Iron Butterfly, to learn how profit can be make from a volatile stock.

Return from Long Call Condor to Option Strategies