Short Strangle

Direction: Sideways

Strategy Description

Short Strangle is one of the sideway strategies employed

in a low volatile stock. It usually involves selling Out of The Money

puts and calls options with the same expiration date and underlying

stock but different strike price.

= Short Call (Out of The Money) + Short Put (Out of Money)

Outlook: With this stock option trading strategy, your outlook is directional neutral.

You are expecting a drop in volatility or no movement of the underlying stock.

Risk and Reward

Maximum Risk:

- Unlimited to the upward or downward movement of the underlying stock.

Maximum Reward :

- Limited to the Net Premium Collected from the Out of The Money puts and calls options sold.

Breakeven :

- Upside Breakeven = Strike Price Plus Net Premium Collected

- Downside Breakeven = Strike Price Less Net Premium Collected

- This is a net credit trade as you are selling the puts and calls options with different strike price but same expiration date.

Advantages and Disadvantages

Advantages:

- Collect premium from puts and calls options and benefit from double time decay and a contraction in volatility.

- Higher probability of a profitable trade compare to a Short Straddle strategy due to selling Out of The Money options which has the effect of widening the strike and breakeven point.

- Potentially unlimited loss beyond the breakeven point in either direction if the strike price, expiration date or underlying stock are badly chosen.

- Limited reward. Lower amount of credit collected compare to a Short Straddle strategy.

- High risk strategy. Not recommended for inexperience traders.

Exiting the Trade

- Let the options expire worthless and earn the full sum of premium collected

- Simply offset the spread by buying back the puts and calls options that you sold in the first place.

Short Strangle Example

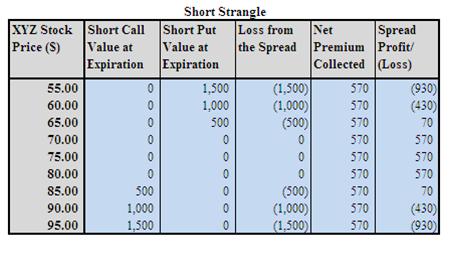

Assumption: XYZ is trading at $75.75 a share on Mar 20X1. You are expecting share price of XYZ to fluctuate back and forth within a range. However you would like to have a higher probability of profitable trade compare to a short straddle strategy. In this case, you may consider to sell one Apr 20X1 $80 strike call at $2.80 and sell one Apr 20X1 $70 strike put at $2.90 to profit from the sideway movement of the stock. Note: commissions are NOT taken into account in the calculation.

Analysis of Short Strangle Example

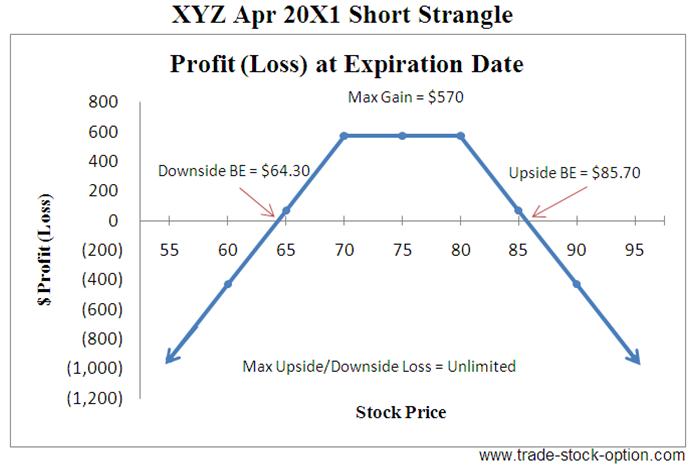

Maximum Risk

= Unlimited beyond the upside and downside breakeven point of the underlying stock

Maximum Reward

= Limited to the Net Premium Collected

= ($2.80 + $2.90) * 100 = $570

Upside Breakeven

= Strike Price Plus Net Premium Collected

= $80 + $5.70 = $85.70

Downside Breakeven

= Strike Price Less Net Premium Collected

= $70 - $5.70 = $64.30

This is a simple adjustment to the Short Straddle strategy to give it a relatively higher probability to a profitable trade by selling Out of The Money options. It is the direct opposite of a Long Strangle and easy to understand. You just need to sell an equal number of puts and calls options with different strike price but same expiration date. Then you can make a profit when the stock fluctuates back and forth within a range.

The maximum profit occurs when the underlying stock is trading between the strike prices at expiration date (where both puts and calls options expire worthless). This option strategy can be executed at any combination of strike prices but is typically established mid point of strike price near At The Money option.

Try to ensure that the stock is trading range bound and identify clear areas of strong support and resistance. Ideally you are selling the options when the implied volatility is high and receive above average premium. The stock is also anticipated to consolidate (become less volatile) and trading sideway for the duration of your trade.

This is a net credit trade as you are receiving the premium for both the puts and calls options sold.

Remembering that the last month of an option’s life has the greatest amount of time value erosion occurring.

Therefore it is preferably to use this option trading strategy with around 1 month left to expiration so as to give yourself less time to be wrong.

This stock option strategy is typically a bet on

the volatility contraction. It is used to try to double the amount of

premium collected compare to only trading one side of the market.

However, I would like to highlight again that you are exposed to

potentially unlimited risk and you should NEVER trade this

strategy right before news or earning announcement! You may be earning

modest income on this strategy for a few months but one big loss will

wipe off your years of gains. It’s just not worth it.

Whether to use a Short Strangle or Short Strangle is typically a

judgment call between amount of premium collected and probability of

stock trading within the range. You should pick the strike price and

time frame of the Short Strangle according to your risk/reward tolerance

and forecast outlook of the underlying stock. Selecting the option

trading strategies with appropriate risk-reward parameters is important

to your long term success in trading options.

Related Strategies

|

|

|

Short Straddle

|

Long Iron Condor

|

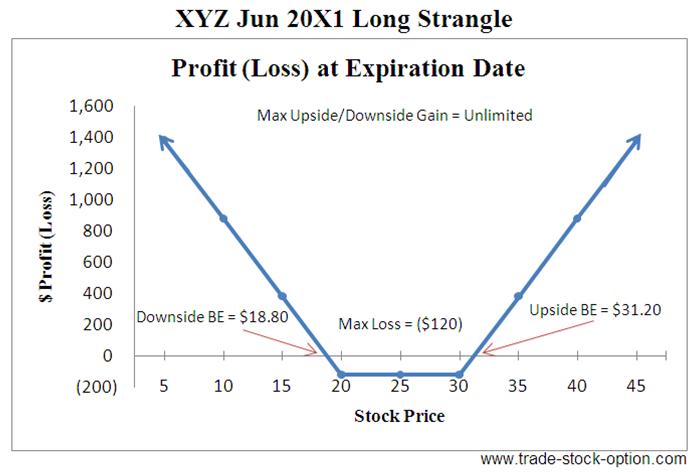

Long Strangle

|

Next go to another sideway strategy, Long Call Butterfly, to learn how profit can be make from a range bound stock.

Return from Short Strangle to Option Strategies